🗒️ With $200M in revenue, Midjourney could be worth $10B

CBInsights: Midjourney — a bootstrapped generative AI startup focused on image generation — has reportedly hit $200M in ARR. We analyze its competitive landscape and potential valuation.

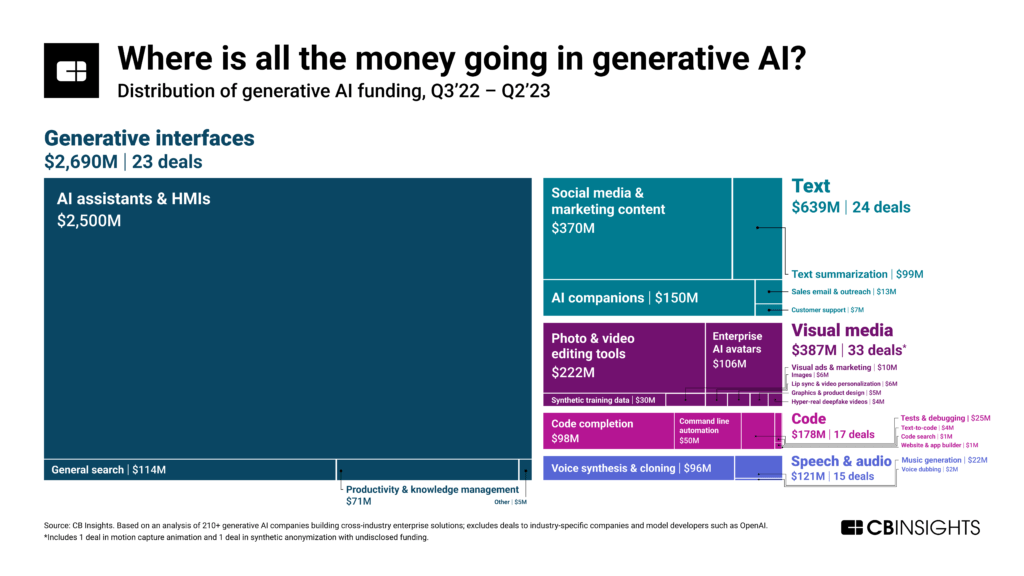

Within generative AI, image generation — a subset of visual media generation — is gaining traction.

🗒️ Saudi mega-project commits to $50M investment in Web3 gaming firm Animoca

Blockworks: Saudi Arabia’s NEOM initiative has proposed a $50 million investment in the Web3 gaming and investment company Animoca Brands.

NEOM’s investment division has teamed up with Animoca to further Web3 projects in alignment with Saudi Arabia’s Vision 2030 strategy.

According to an announcement on Tuesday, half of the $50 million investment will come through convertible notes with a capped conversion price of $4.50 AUS per share, while the other half will be used to acquire Animoca shares from the secondary market.

Animoca’s share price is likely listed in Australian dollars as the firm was once listed on the Australian Securities Exchange (ASX). It was delisted from the ASX in 2020 due to non-compliance issues, yet it still trades on the secondary market.

🗒️ Billionaire Charlie Munger, Warren Buffett’s right-hand man, says a lot of venture capitalists screw their investors

Yahoo Finance: Billionaire Charlie Munger, Warren Buffett’s right-hand man, isn’t shy about his dislike for venture capitalists. In 2014, the legendary investor told the Wall Street Journal that it would be better for venture capital funds to light their money “on fire with an acetylene torch” than to invest in internet startups. Now, at the age of 99, soon to turn 100 on Jan. 1, he has another message for venture capitalists: “To hell with them!”

Munger, vice chairman of the famed holding company Berkshire Hathaway and one of the world’s most successful investors, discussed his disdain of venture capitalists, as well as his obsession with Costco, the state of the global stock market, and the concept of investing versus gambling, on the podcast Acquired on Sunday.

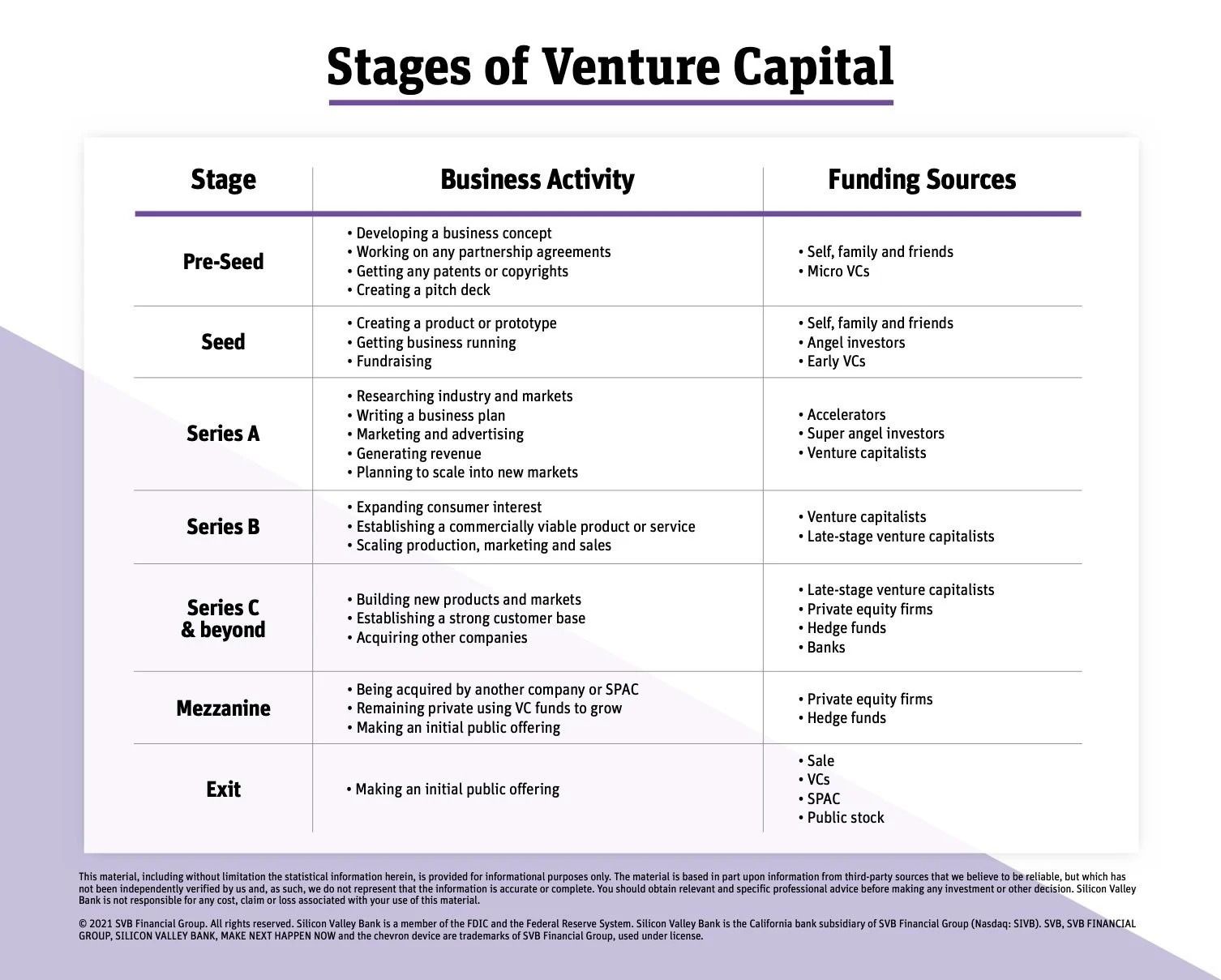

🗒️ Stages of venture capital

SVB:

- There are five stages of capital funding that range from the initial seed stage to the mezzanine stage that precedes an IPO.

- There are different funding sources available to help you scale at different points along your entrepreneurial journey.

- To gain funding, your company needs to be mature enough to draw investor interest.

Venture capital (VC) firms pool money from multiple investors to help fund companies with high growth potential. In exchange for the investment, VC firms take equity or an ownership stake in your company.

In addition to VC firms, corporate VC funds, and more frequently high net worth family offices, are investing in startups.

VCs make it possible for promising entrepreneurs, some with little or no operating history, to secure capital to launch their business.

VCs and other investors make it possible for promising entrepreneurs, some with little or no operating history, to secure capital to launch their business. In return for taking on the risk of investing in unknown and unproven startups, investors take an equity stake with the hope of significant returns if the companies become a success.

When choosing companies, VCs and other investors consider:

- Your growth potential

- The strength of your management team

- The appeal or uniqueness of your products or services

VCs firms can generally absorb several losses as long as they occasionally invest in a runaway success to distribute returns to investors. To improve the chances of success, when you take VC funding, you’ll likely get guidance from experienced investors and entrepreneurs. Often, these firms will also expect some say in decision-making, including a seat on the board.

There are five key stages of venture capital, with two additional stages that occur before and after VC funding.

Top 3 book summaries this week 📚

Predictable Prospecting by Marylou Tyler

There are a lot of challenges in business, with a predictable revenue generation process almost always taking top spot. It’s kind of like oxygen for your business - without it, you die. To get predictability in revenue, you need to have predictable lead generation. Learn how to do it in this book summary.

The Fifth Discipline by Peter Senge

Senge's argument is that a learning organization - one that seeks to facilitate and encourage learning at all levels of a company so that it can continually transform itself - provides a better way of doing things. This is one of those books that takes a few times through to wrap your head around the argument and the so-lutions, but the payoff is worth it.

Deep Work by Cal Newport

Newport's main argument in the book is that the ability to perform deep work is becoming increasingly rare at exactly the same time it is becoming increasingly valuable in our economy. As a consequence, the few who cultivate this skill, and then make it the core of their working life, will thrive.