🗒️ Google invested a whopping $1.5B into blockchain companies since September

Cointelegraph: Google parent company Alphabet poured the most amount of capital into the blockchain industry compared to any other public company, investing $1.5 billion between Sep. 2021 and Jun. 2022, a new report shows.

In an updated blog published by Blockdata on Wednesday, Alphabet (Google) was revealed as the investor with the deepest pockets compared to the top 40 public corporations investing in blockchain and crypto companies during the period.

The company invested $1.5 billion into the space, concentrating on four blockchain companies including digital asset custody platform Fireblocks, Web3 gaming company Dapper Labs, Bitcoin infrastructure tool Voltage and venture capital company Digital Currency Group.

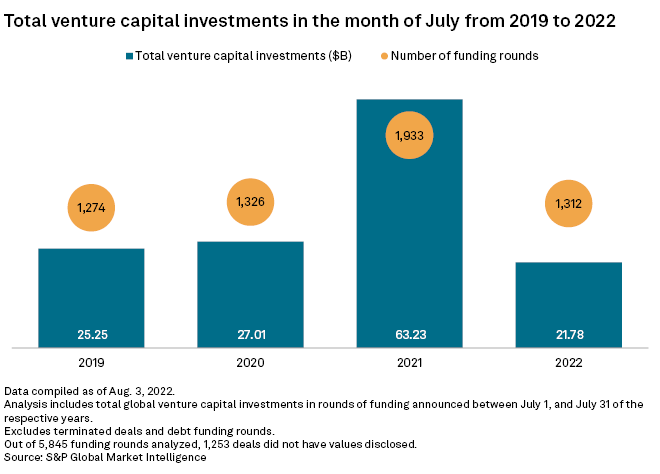

🗒️ Global venture capital funding rounds continue decline in July

S&P Global Market Intelligence: The value of global venture capital-backed funding rounds fell 65.6% year over year in July to $21.78 billion, while the number of rounds was down 32.1%, according to S&P Global Market Intelligence data.

The amount raised in July is the lowest since April 2020, when $19.69 billion was pulled in, the data shows.

Companies based in the U.S. and Canada received $9 billion in 408 funding rounds, Asia-Pacific drew $6.6 billion in 506 transactions, and Europe secured $5.2 billion in 329 rounds.

🗒️ Hello Alice, Mastercard launch small-business credit card to better support capital access

Business Journals: Houston-based business services platform Hello Alice is teaming up with New York-based Mastercard Inc. (NYSE: MA) on a new financial product.

In partnership with Mastercard and First National Bank of Omaha, Hello Allice is launching a "Hello Alice Small Business Mastercard" to broaden its portfolio of capital products, the company announced Aug. 16. The product features several offerings tailored specifically for small businesses, including on-demand access to professional business advisers and rewards for purchasing things like office supplies, wireless telephone services, business software and more.

The product was also designed to maximize access to capital and opportunities to build credit for small-business owners, Hello Alice said. Business owners with limited or poor credit history can use a specific credit-building credit card to access the card's full benefits while improving their credit. They can then graduate from a secured card, which requires a security deposit in order to open an account, to an unsecured card with a revolving line of credit.

🗒️ “We look at investments as a two-way street,” says Amex Ventures

CTech: “For a startup, working with a CVC provides more than just capital investment,” said Margaret Lim, Managing Director at Amex Ventures. “CVCs are the investment arms of large established organizations – and that has its unique value. For example, Amex Ventures brings the startups we invest in into our internal ecosystem and connects them with various teams across our business to explore partnerships and growth opportunities with our customers.”

Amex Ventures is a corporate venture capital fund founded in 2011 to help American Express’ core capabilities and accelerate efforts in consumer commerce and B2B services. According to Lim, the CVC can invest in companies whose technologies can augment and enhance Amex’s existing capabilities, or companies that can help deliver new benefits and features to its customers.