Top 4 Curated Venture Capital Weekly Update for 01Mar2023💰

🗒️ How the titans of tech investing are staying warm over the VC winter

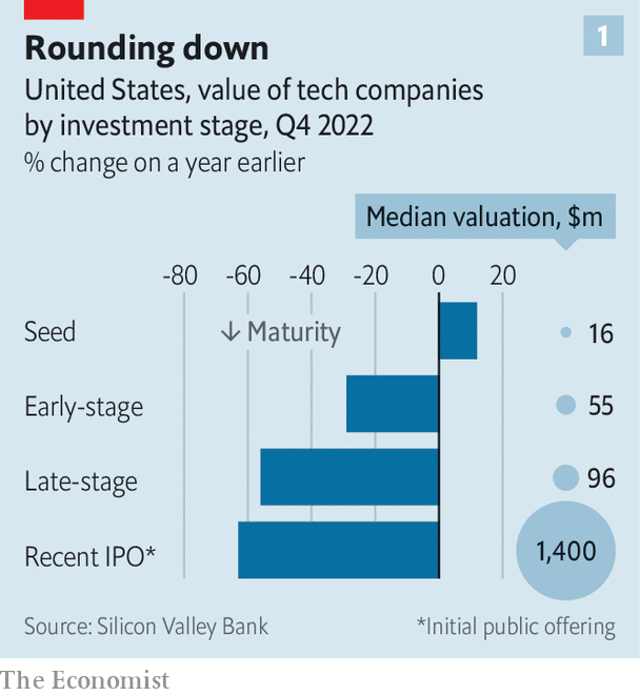

Economist: Venture capitalists are not known for humility. But many have been striking a humbler tone of late. In a recent letter to investors Tiger Global, a hedge fund and venture-capital (vc) investor, reportedly admitted that it had “underestimated” inflation and “overestimated” the boost from the covid-19 pandemic to the tech startups in its portfolio. In November Sequoia, a Silicon Valley vc blue blood, apologised to clients after the spectacular blow-up of ftx, a now defunct crypto-trading platform that it had backed. In January Jeffrey Pichet Jaensubhakij, chief investment officer of gic, one of Singapore’s sovereign-wealth funds, said he was “thinking much more soberly” about startup investing.

🗒️ Taking stock of Black venture capital dollars

Axios: Over the last several years, the venture capital industry has made countless pledges about hiring and funding more Black investors and entrepreneurs. However, venture dollars under Black management remain small.

By the numbers: Of the U.S. venture assets under management (about $1.42 trillion) in 2020, a slim 1% worth of capital was managed by Black investors, according to data compiled by Harvard Business professor Paul Gompers and Cleo Capital managing director Sarah Kunst.

-

And looking at gender, 99.97% of total capital under management by Black VCs was controlled by men, while women only managed 0.03%.

-

The data focuses on senior investors (general partners and similar titles) who have check-writing authority.

Why it matters: The business world is often quick to respond to criticism about lack of diversity with public relations, so looking at the actual dollars an investor manages is a reality check.

🗒️ Special Series: Black-Founded Startups Raised Large Rounds, Added 3 Unicorns in 2022

Crunchbase: Editor’s note: This article is the second of our three-part series on the state of venture investment to Black-founded startups in 2022. Driving these reports are data from Crunchbase’s Diversity Spotlight feature, which helps indicate diversity in startups’ and investment firms’ leadership teams. Part One introduced the funding landscape for Black-founded startups in 2022, and Part Three focuses on VC investment in Black-founded health care startups. — Special Projects Editor Christine Kilpatrick

Esusu, a fintech startup that helps renters build credit with on-time payment reporting, was rejected 326 times by investors prior to its 2022 funding that valued the company at a billion dollars.

Investors who passed over the company did not believe in “this idea of investing in low- to medium-income households and helping them get quality financial access to products,” said Wemimo Abbey, Esusu’s co-founder and co-CEO.

That all changed in early 2022, when Esusu raised a $130 million Series B funding led by the SoftBank Vision Fund — just six months after announcing its Series A in 2021.

🗒️ Angel Investing vs. Venture Capital: Which Is Better For Your Startup?

Yahoo Finance: Angel investors and venture capitalists tend to operate in the same circles. While both invest in startup companies and new technologies, they’re otherwise very different. An angel investor is generally an individual looking to invest their own money in a startup business. A venture capital firm is a group looking to invest its clients’ money in new companies. This leads to stark differences in how these investors operate.

Consider working with a financial advisor if you’re looking for investment advice on where and how to invest your money.