🗒️ ChatGPT Creator OpenAI Discussing Offer Valuing Company At $29 Billion, Report Says

Forbes: OpenAI—the artificial intelligence company behind the viral ChatGPT chatbot program—is in discussions to sell shares valuing the firm at $29 billion, according to the Wall Street Journal, after the launch of ChatGPT was lauded by many as a revolutionary advance in artificial intelligence despite some problems.

-

The Founders Fund and Thrive Capital venture capital firms are reportedly in talks to buy at least $300 million in shares.

-

The deal would more than double a 2021 tender offer for shares that valued the company at around $14 billion, according to the Journal.

-

OpenAI is not publicly traded, but many of the shares could reportedly be purchased from shareholders like employees.

-

OpenAI declined to comment or confirm the report

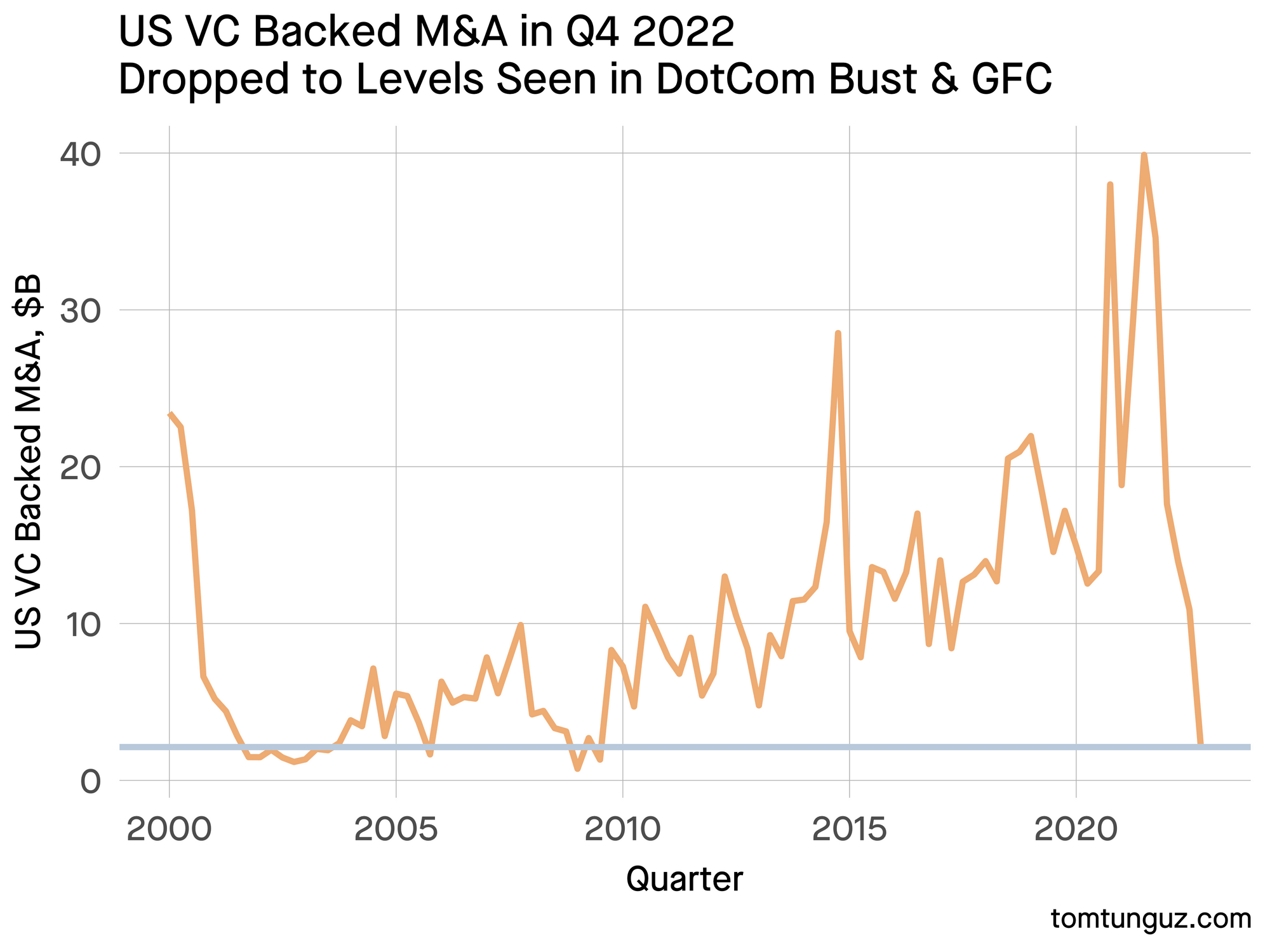

🗒️ The Startup M&A Market Fell 94% Year over Year - But One Segment is Thriving

Tomasz Tunguz: The total quantity of acquisitions demonstrated greater resilience shrinking by 56%, while the median acquisition value tumbled from $81m to $22m (-72%).

A $22m median M&A price implies most of these transactions were acquihires - acquisitions that value a company for its team. There are 3 types of acquisitions: team ; team & technology ; team, technology & revenue.

During a down-market, young startups who face a radically more challenging fundraising market than six months ago more often choose a quick sale. M&A secures the team greater financial certainty within a more established & better capitalized business.

🗒️ Black Founders in the US See Only 1% of Venture Capital Funding in 2022: Here’s How to Fix the Disparity

StupidDope: Black founders in the United States faced significant challenges in 2022 when it came to raising venture capital, according to data from Crunchbase. In Q4 of 2022, Black startup founders raised just $264 million out of the total $33.6 billion in venture capital allocated, representing a mere 0.78% of the total. This is an increase from the $178 million, or 0.43%, that Black founders raised in Q3 of 2022.

While this represents a small increase quarter-over-quarter, the overall trend for Black founders in 2022 was not positive. In total, Black founders in the U.S. raised an estimated $2.254 billion out of the $215.9 billion in U.S. venture capital allocated for the year, a decline from the 1.3% raised in 2021.

This disparity in funding highlights the systemic barriers and biases that Black founders continue to face in the venture capital industry. It also highlights the need for more diverse representation in the venture capital community and for greater efforts to support and invest in Black-led startups. Without these changes, the gap between Black and non-Black founders in terms of access to funding is likely to persist.

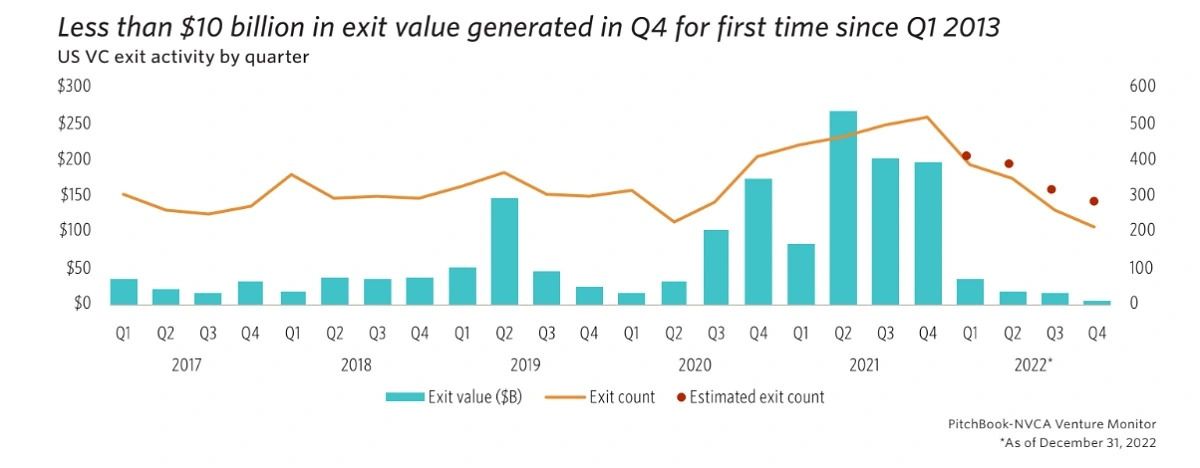

🗒️ U.S. VC investments and exits plummeted in 2022 | NVCA

Venturebeat: The deal count in 2022 for the full year was 15,852, down 14% from 18,521 in 2021. And deal value was $238.3 billion, down 30% from $344.7 billion a year earlier, according to a report by Pitchbook and the National Venture Capital Association (NVCA).

U.S. VC exit activity was 1,208 deals valued at $71.4 billion, down dramatically from 1,925 deals valued at $753.2 billion a year earlier

With each quarter the deal activity declined and that could foreshadow a slide in 2023, the report said.

On an annual basis, angel- and seed-stage deal activity remained relatively resilient in 2022, with $21.0 billion invested across an estimated 7,261 deals. However, the four consecutive quarters of declining deal counts could foreshadow a continued slide in 2023. Seed-stage deal sizes and pre-money valuations demonstrated notable growth over the 2021 figures due in part to a large number of actively investing micro-funds as well as the participation of nontraditional and crossover investors.