🗒️ There is No Such Thing as Series A Metrics

Tomasz Tunguz: In There’s No Such Thing as Series A Metrics, Charles Hudson explains that there is no magic milestone to raise a Series A.

In this environment, I agree. The $1m ARR figure used to hold in 2018 & early 2019. But the data shows how much the market differs from a few years ago.

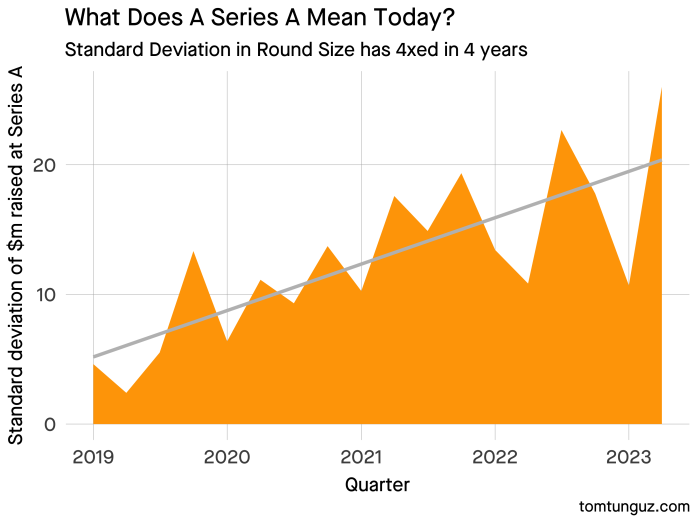

Series A round size standard deviation has grown by between 4-5x in 4 years.

🗒️ San Francisco Companies Got Half the World’s AI Funding So Far This Year

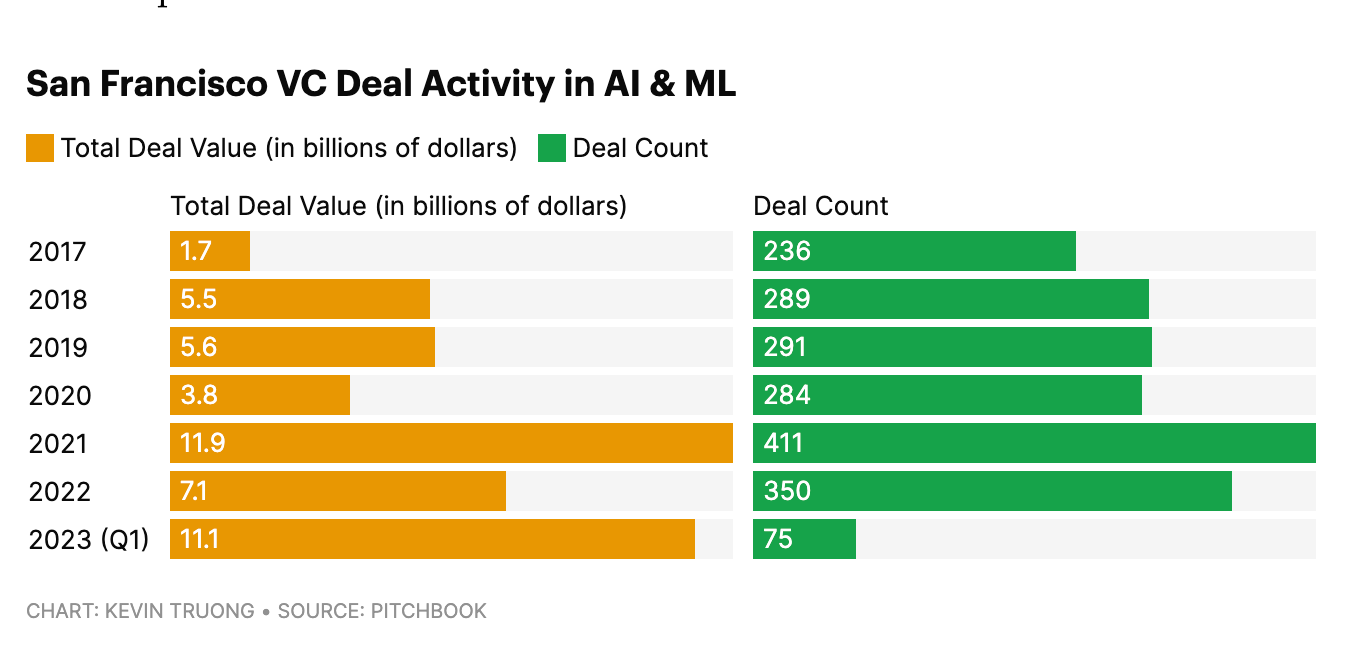

The San Francisco Standard: Nearly half of all funding for Artificial Intelligence and machine learning startups worldwide in the first three months of this year went to San Francisco companies, according to the venture capital database Pitchbook.

Out of the $22.7 billion that investors put into these companies in the first quarter of 2023, $11.1 billion went to San Francisco-based firms, according to the data. That means San Francisco AI companies are on pace to break their 2021 funding record of $11.9 billion over 411 deals.

The vast majority of the money went to ChatGPT developer OpenAI, which received $10 billion from Microsoft in a complex partnership deal that includes supercomputing capacity, cloud services from Microsoft Azure and research collaborations between the two companies.

🗒️ Here’s How to Thrive During the Shifting VC Funding Environment

Builtin: "The party’s over.”

Whenever a financial boom goes bust, this phrase inevitably comes up from pundits, experts, colleagues and, of course, venture capitalists. The warnings began in late 2022 and have proven true in 2023’s statistics.

For early-stage companies, these declines feel especially difficult. Without a track record of success and a still-blossoming vision for an idea’s future, finding traditional sources of funding becomes even more challenging. The situation is even more disproportionate for women- and minority-led businesses: women-run startups saw a decrease in their percentage of all VC funding in 2022, to 1.9 percent down from an already dismal 2.4 percent in 2021. Meanwhile, venture capital for Black entrepreneurs decreased by 45 percent in 2022.

🗒️ Global venture capital investment tumbles YOY in June

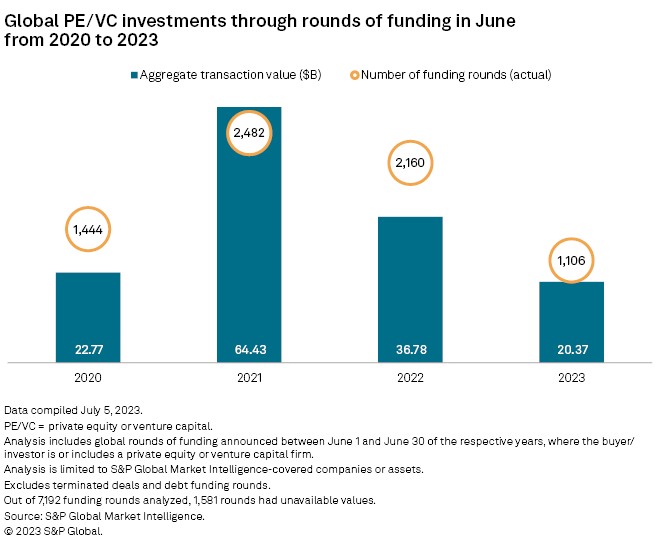

SP Global: Venture capital investments worldwide dropped 44.6% to $20.37 billion in June from $36.78 billion in the same month in 2022, according to S&P Global Market Intelligence data.

The number of funding rounds declined 48.8% to 1,106 from 2,160 a year earlier and was down more than 10% from 1,234 in the previous month.

The total investment value in June slightly improved from May, when $19.46 billion was raised, the latest Market Intelligence data shows.

Top 3 book summaries this week 📚

Gen Z at Work by David Stillman

For the first time in history we have 4 different generations at work at once. Baby Boomers, Gen X and Millen-nials get most of the attention.

Now Gen Z is starting to flood into the workforce, it's time to learn who they are and how to best lead them. This book will give you the seven Gen Z traits we need to be aware of.

Asking Questions The Sandler Way by Antonio Garrido

Most sales reps use a "show and and throw up" process for selling. The best sales reps, however, are adept at asking great sales questions.

Watch this summary to explore the seven stages of the Sandler Selling System and the questions you can ask in each to become a more effective sales person.

The Culture Code by Daniel Coyle

Group culture is one of the most powerful forces on the planet. We sense its presence inside successful busi-nesses, championship teams, and thriving families, and we sense when it’s absent or toxic.

In this book, Coyle argues that culture is not something you are, but that it is created by a specific set of skills. Learn what they are and how to develop them in this summary.