🗒️ A new age in investing: The transformative power of asset tokenization

Cointelegraph: Asset tokenization has long been regarded as one of the most compelling applications of blockchain technology. Back in June 2019, the United States investment banking giant BNY Mellon declared it has the potential to “dramatically change the dynamic” for investors and unlock opportunities that were previously out of reach.

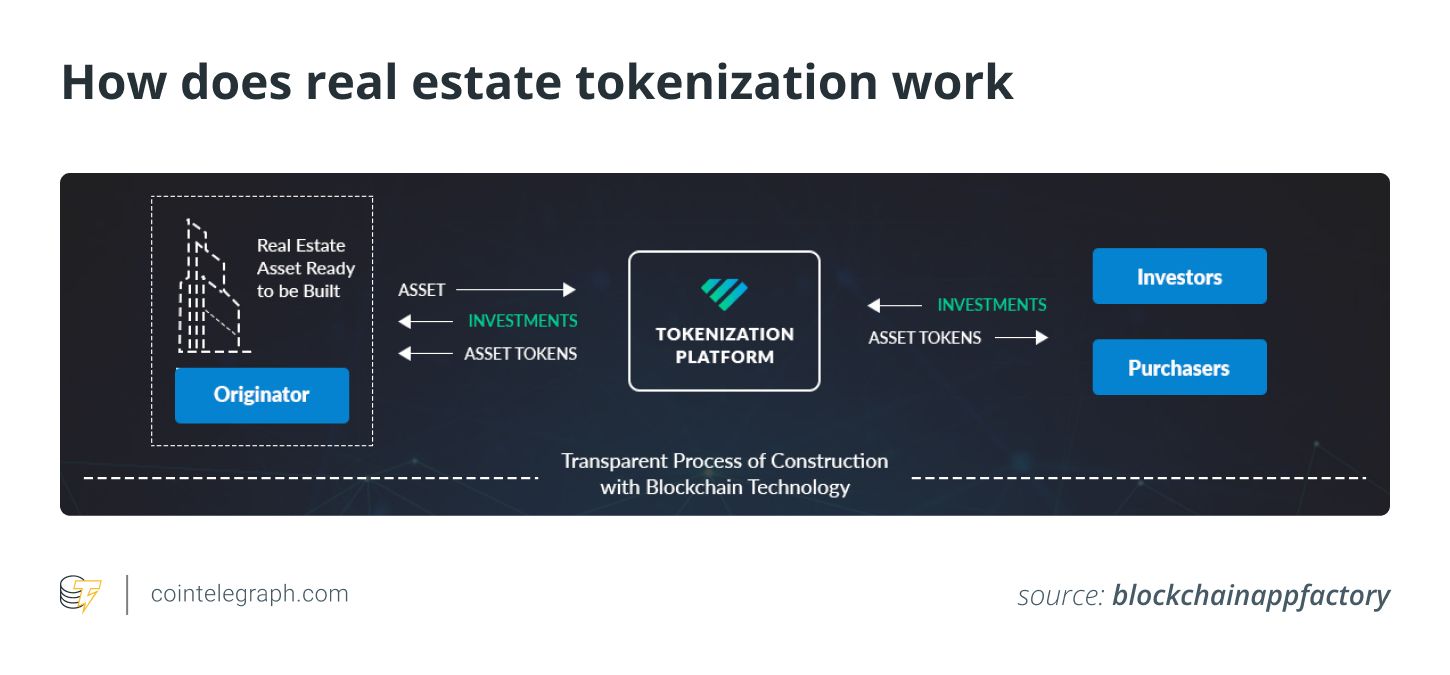

Real estate is an inevitable place to start. Tokenizing properties can open the door to fractional ownership, enabling individuals to purchase a small chunk of a building. The volatility of global markets has shown why diversification is crucial — but until now, the sheer cost of real estate has made it inaccessible for many.

🗒️ Venture’s Q2 was calm (and that’s not good)

Techcrunch: Hello, and welcome back to Equity, the podcast about the business of startups, where we unpack the numbers and nuance behind the headlines.

So, what happened in venture capital-land during Q2 2023? A lot, and not very much. The TechCrunch+ crew have been busy as bees in a meadow trying to get our heads around the data. So, we got PitchBook venture guru Kyle Stanford to come back on the podcast to riff with us on the good, the bad, and the late-stage.

Here’s what we got into:

- How did American venture perform in Q2 2023? Welcome to the new normal, and why that’s actually bad news.

- How are Seed deals faring, and what about later-stage transactions?

- How bad is the slow pace of exits today, and what impact will they have on venture capital fundraising itself? More on the topic here.

- And, any green shoots popping up? Here’s a rundown of what could be considered good news.

🗒️ Venture Capital Firm CoinFund Raises $158 Million to Drive Innovation in Early-Stage Crypto and AI Companies

Cryptonews: The crypto-focused venture capital firm CoinFund has closed a fundraising round for its latest VC fund, the CoinFund Seed IV Fund, after raising $158 million from investors.

The investors in the new fund are a combination of family offices, institutional investors and high-net worth individuals, an announcement from CoinFund said.

The announcement added that the amount raised far exceeded its initial fundraising goal of $125 million, despite a general slump in the market for VC investing.

“The Fund will support pre-seed and seed stage investments in new and ambitious founding teams across the web3 ecosystem,” the announcement said.

🗒️ Founders: don't build a unicorn

Sifted: Most founders should not be raising venture capital.

You do not need to build a unicorn.

Nine times out of ten, you’d be better off focusing on revenue, raising a small round from angels or a micro VC if needed, getting to profitability and being acquired by another company in your industry. Or hanging on and growing profitably.

This path can produce life-changing money for you and great returns for your angel investors, at lower risk.

Top 3 book summaries this week 📚

The Upside of Stress, by Kelly McGonigal

As it turns out, whether or not stress is harmful has a lot to do with how you view it.

The Speed of Trust, by Steven Covey

Steven Covey believes that trust is "the one thing that changes everything” in both business and life. Our summary reveals the steps you can take to foster this powerful force in all of your relationships.

When Millennials Take Over, by Maddie Grant and Jamie Notter

Millennials are revolutionizing the way we view business. The social internet is powerful, but it was never going to revolutionize management on its own. And that’s where the Millennial steps in.