In this post, we'll define what an NFT is, show a few examples of how an NFT is used.

What is an NFT?

Non-fungible tokens (NFTs) are cryptographic assets on a blockchain with unique identification codes and metadata that distinguish them from each other. Unlike cryptocurrencies, they cannot be traded or exchanged at equivalency. This differs from fungible tokens like cryptocurrencies, which are identical to each other and, therefore, can serve as a medium for commercial transactions. Source: investopedia.com

What's the difference between NFTs and cryptocurrency?

NFTs and cryptocurrencies rely on the same underlying blockchain technology. NFT marketplaces may also require people to purchase NFTs with a cryptocurrency. However, cryptocurrencies and NFTs are created and used for different purposes.

Cryptocurrencies aim to act as currencies by either storing value or letting you buy or sell goods. Cryptocurrency tokens are fungible tokens, similar to fiat currencies, like a dollar. NFTs create one-of-a-kind tokens that can show ownership and convey rights over digital goods. Source: businessinsider.com

Why Are Non-Fungible Tokens Important?

Non-fungible tokens are an evolution of the relatively simple concept of cryptocurrencies. Modern finance systems consist of sophisticated trading and loan systems for different asset types, ranging from real estate to lending contracts to artwork. By enabling digital representations of physical assets, NFTs are a step forward in the reinvention of this infrastructure.

To be sure, the idea of digital representations of physical assets is not novel nor is the use of unique identification. However, when these concepts are combined with the benefits of a tamper-resistant blockchain of smart contracts, they become a potent force for change.

Perhaps, the most obvious benefit of NFTs is market efficiency. The conversion of a physical asset into a digital one streamlines processes and removes intermediaries. NFTs representing digital or physical artwork on a blockchain remove the need for agents and allow artists to connect directly with their audiences. They can also improve business processes. For example, an NFT for a wine bottle will make it easier for different actors in a supply chain to interact with it and help track its provenance, production, and sale through the entire process. Consulting firm Ernst & Young has already developed such a solution for one of its clients.

Non-fungible tokens are also excellent for identity management. Consider the case of physical passports that need to be produced at every entry and exit point. By converting individual passports into NFTs, each with its own unique identifying characteristics, it is possible to streamline the entry and exit processes for jurisdictions. Expanding this use case, NFTs can serve an identity management purpose within the digital realm as well.

NFTs can also democratize investing by fractionalizing physical assets like real estate. It is much easier to divide a digital real estate asset among multiple owners than a physical one. That tokenization ethic need not be constrained to real estate; it can extend to other assets, such as artwork. Thus, a painting need not always have a single owner. Its digital equivalent can have multiple owners, each responsible for a fraction of the painting. Such arrangements could increase its worth and revenues.

The most exciting possibility for NFTs lies in the creation of new markets and forms of investment. Consider a piece of real estate parceled out into multiple divisions, each of which contains different characteristics and property types. One of the divisions might be next to a beach while another is in an entertainment complex, and yet another is a residential district. Depending on its characteristics, each piece of land is unique, priced differently, and represented with an NFT. Real estate trading, a complex and bureaucratic affair, can be simplified by incorporating relevant metadata into each unique NFT. Decentraland, a virtual reality platform on Ethereum’s blockchain, has already implemented such a concept.

As NFTs become more sophisticated and integrate into the financial infrastructure, it may become possible to implement the same concept of tokenized pieces of land (differing in value and location) in the physical world. Source: investopedia.com

Why are NFTs so popular?

There are a few reasons for the popularity of NFTs. First, they offer true ownership of digital assets. Second, they are scarce and unique, which makes them valuable. And finally, they are easy to use and trade.

What Can be Made into an NFT?

Most NFTs come with unique properties and can be made from any kind of digital content like photographs, art, music, GIFs, or a video clip they are so versatile that they can even include tweets and memes in the NFT marketplace. Thanks to the NFT marketplaces that act as auction houses they have made it easy for trading in NFTs and offer support on how to sell an NFT. Source: smallbiztrends.com

How Secure are NFTs?

The growing popularity of NFTs has promoted active discussions regarding NFT security. Since it is a novel technology, the level of NFT safety is not high enough to guarantee the absolute security of investors' assets.

One of the main NFT risks threatening investors and projects is scams. Malicious actors impersonate popular platforms, exchanges, or wallets to steal users' private data required to get access to their virtual assets and thereby affect NFT security.

A significant NFT risk is related to possible purchase of fake non-fungible tokens. Malicious actors may impersonate well-known creators and sell fake certificates of ownership. For example, this Summer, a collector known as Pranksy purchased fake Banksy NFT for 244,000 GBP . Thus, a serious NFT vulnerability is attributable to NFT trading. Artists even do not know that their works are sold without their consent. The fact that anyone can tokenize the content created by other people makes the question “Are NFTs safe” so actual for the global blockchain community.

NFT security heavily depends on the ability of centralized platforms to protect the private keys of all assets stored on them. Even when platforms apply the most advanced security measures, a serious NFT risk is related to the failure of their users to securely store their passwords and other private data by accessing which malicious actors can steal their non-fungible tokens.

In some cases, NFTs purchased by individual art lovers may become inaccessible. When a user purchases an NFT, he actually gets a reference to the file where the artwork is stored. This artwork is not actually logged into the blockchain, it can be stored anywhere. NFT platforms may decide to close their windows whenever they want. As a result, a user cannot display his file although it still exists.

NFT security also depends on the ability of users to apply critical thinking. Malicious actors like organizing so-called giveaways offering users NFTs for free. However, to participate in these giveaways users need to send the specified amount of cryptocurrency/ies. Of course, in most cases, users do not get any NFTs. Source: hacken.io

Types of NFTs

NFTs can be classified into three broad categories:

-

Physical NFTs: These are NFTs that represent physical assets. For example, a physical NFT could represent a piece of land or a building.

-

Financial NFTs: These are NFTs that represent financial assets. For example, a financial NFT could represent a debt instrument or an equity stake.

-

Digital NFTs: These are NFTs that represent digital assets. For example, a digital NFT could represent a piece of art or a video clip.

POAPs (Proof of attendance protocol). If you contribute to ethereum.org, you can claim a POAP NFT. These are collectibles that prove you participated in an event. Some crypto meetups have used POAPs as a form of ticket to their events.

Etereum.org use NFTs to give back to their contributors and we've even has their own NFT domain name.

ethereum.eth. This website has an alternative domain name powered by NFTs, ethereum.eth. Our .org address is centrally managed by a domain name system (DNS) provider, whereas ethereum.eth is registered on Ethereum via the Ethereum Name Service (ENS). And its owned and managed by us. Source: ethereum.org

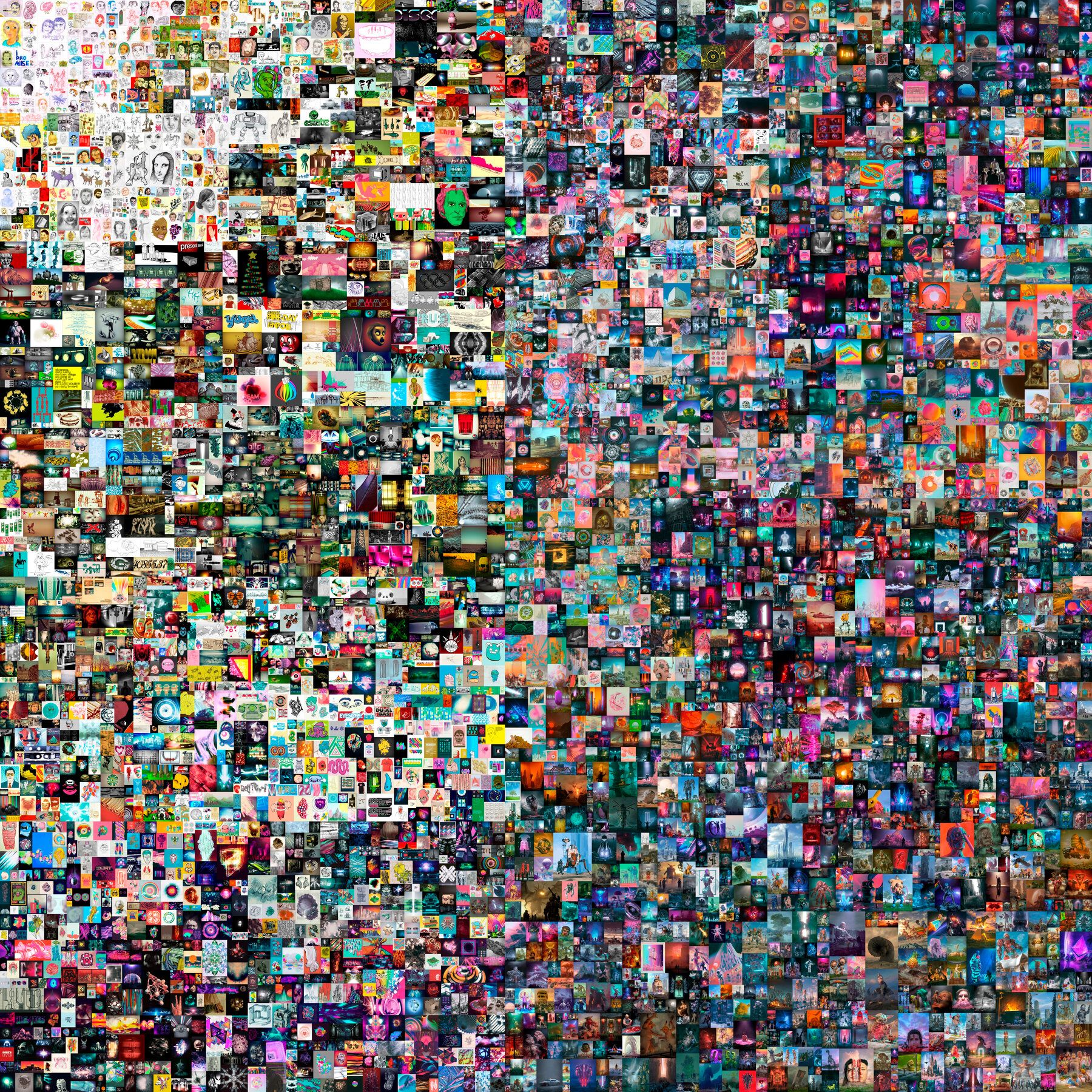

NFT examples

The NFT world is relatively new. In theory, the scope for NFTs is anything that is unique that needs provable ownership. Here are some examples of NFTs that exist today, to help you get the idea:

- Decentralized Art and Collections

Since the value of art is dependent on a range of factors including the authenticity, age and number of owners, it makes perfect sense to store it as an NFT on the Blockchain. Artists often have problems proving the authenticity of their work, especially with digital art. However, the use of the Blockchain and NFT’s can help solve this problem. Currently, an artist may publish their artwork on their website, social media or a blogging site, however, this doesn’t prove ownership, many of these platforms often don’t even offer a reliable date stamp. However, through the use of Blockchain and NFT’s artists can upload their art to a website that adds these details to the Blockchain. This means that the author’s details and authenticity of the art can be stored on the tamperproof and secure Blockchain. As everything is recorded on a public ledger it becomes possible to trace the art to the owner and the first date it was published. Source: uxsequence.io

2. Music

Digital art is not the only thing that can be turned into NFTs. For example, many NFT marketplaces also support music files. While music has been fungible for decades, some artists decided to end music distribution as we know it. Moreover, musicians usually earn only a small percentage of their royalties. With NFTs, they can earn way more and earn close to 100%. Plus, the NFT technology allows them to create unique musical pieces that change every time their owner comes back to hear them. Musical NFTs are usually safe to hold when they’re sold by an original owner. Unfortunately, some platforms were accused of stealing music from musicians and selling it as NFTs without permission.

3. Video Game Items

Video games have been quite popular for a while, and avid gamers will do anything to get new shiny armor or a unique character, including purchasing an NFT. Once a virtual in-game asset gets transformed into NFT, it can’t be deleted or changed in any way, which guarantees ownership to the player. Furthermore, since in-game items are NFTs, they can have unique properties that no other in-game item has. This increases the level of excitement among gamers who are eager to collect the item or use it to win. Like with other types of NFTs, in-game items are as safe as the platform they’re on. If the platform suffers a breach, NFTs can go to the wrong hands.

4. Trading Cards and Collectible Items

People were collecting cards even before the NFTs became popular. However, today, collecting physical cards got replaced by purchasing a rare NFT card. The cards remain the same; it’s only the tech that changed. Plus, once a person gets the card they were looking for, they know nobody else has it, and they can decide to keep it or sell it. Additionally, anything that can be considered a collectible can be sold as NFT for as long as the items are properly formatted and posted on the marketplace. When it comes to collectibles, hackers can get very sophisticated in targeting their victims. Ape_NFTs is the prime example of how hackers used a screen sharing feature to get access to his wallet and wipe out his whole collection.

5. Memorable Sports Moments

The NFT technology allows sports fans to create and sell memorable sports moments. These are short videos of the best moments in sports history, like game-changing touchdowns or slam dunks. These videos last for about 10 seconds and might sell for up to $200,000. Besides the coolest sports moments as NFTs, there are sports NFTs that come with physical memorabilia that guarantees the item’s authenticity. The security of the memorable sports moments also depends on the platform they’re posted on and their owners. These NFTs can also be stolen if the owner makes a mistake, or the platform suffers an attack.

6. Memes

The internet is filled with memes, and they’re everywhere, including the NFT marketplaces. What’s more, sometimes, the person on the meme is the actual seller of the NFT, which makes it even cooler to purchase and own. Some popular NFT memes include Nyan Cat, Bad Luck Brian, Disaster Girl, and others. These sell from $30,000 to $770,000, and the Doge meme sold for an astonishing $4 million. Regarding the security of meme NFTs, it’s the same as with digital art – nobody can download a JPEG and sell it as an NFT as the original will remain on the platform.

7. Domain Names

Domain names are possibly one of the strangest things people can purchase on the NFT marketplace. However, they’re quickly becoming commodities found on NFT marketplaces. One of the recent examples of domain names that sold for a high price of $100,000 is win.crypto. Usually, the domain name is registered at a third-party company that manages it. However, the NFT marketplace cuts out the middleman and provides immediate ownership of the domain. There’s also no need for a renewal fee—the domain is purchased only once. NFT domains are stored in a crypto wallet, meaning they’re as safe as any other funds in the same wallet. However, crypto wallets can still be hacked, which means that NFT domains aren’t perfectly safe either.

8. Virtual Fashion

NFTs entered multiple industries, including fashion. At the moment, Gucci, Reebok, and Puma are experimenting with virtual fashion, which is one step away from turning products into NFTs. Some fashion NFTs are also tied to a physical item. For example, NFT-based fashion brand Overpriced dropped a physical hoodie that comes with a code that shows an NFT. If this hoodie gets stolen, the brand will send a new one to the owner with a completely new NFT code, and Overpriced will invalidate the previous code. Source: globalsign.com

NBA Top Shot Is a Hot NFT Use Case

One of the most popular non-fungible tokens in recent days is NBA Top Shot, a partnership between Dapper Labs (makers of the CryptoKitties game) and the National Basketball Association (NBA). The NBA licenses individual highlight video reels, among other content, to Dapper Labs, and they digitize the footage and make it available for sale to consumers. Each reel shows a video clip, such as a famous player's basketball dunk, some featuring different angles and digital artwork to make them unique. Even if someone made a perfect copy of the video, it can be instantly recognizable as a counterfeit. The venture has already generated $230 million in sales, and the company just also received $305 million in funding from a group that includes Michael Jordan and Kevin Durant. These video reels are selling at high prices.

Among the most popular:

LeBron James “Cosmic” Dunk: $208,000

Zion Williamson “Holo MMXX” Block: $100,000

LeBron James “From the Top” Block: $100,000

LeBron James “Throwdowns” Dunk: $100,000

LeBron James “Holo MMXX” Dunk: $99,999

Steph Curry “Deck the Hoops” Handles: $85,000

Giannis Antetokounmpo “Holo MMXX” Dunk: $85,000

LeBron James “From the Top” Dunk: $80,000

These unique NBA moments are minted and released into the marketplace via “pack drops.” The most common sell for only nine dollars, but more exclusive packs can sell for much more. Source: simplilearn.com

Additional Information about NFTs

Can I make my own NFT?

Yes! Anyone can create their own NFT. All you need is a digital file and an Ethereum wallet.

How do I buy an NFT?

Yes, you can buy an NFT with the help of a cryptocurrency exchange. You will first need to create an account on the exchange and then deposit funds into your account. Once you have done so, you can use the exchange's trading platform to buy an NFT.

What does owning an NFT mean?

Owning an NFT means that you own the digital asset that is represented by the NFT. This can be anything from a piece of art to a tweet. Unlike traditional assets, NFTs can be easily traded and transferred without the need for a middleman.

How do I sell an NFT?

If you want to sell your NFT, you will need to find a buyer who is willing to pay the price you are asking for. You can do this by listing your NFT on an NFT marketplace.

What is an NFT marketplace?

An NFT marketplace is a platform that allows you to buy and sell NFTs. These marketplaces act as digital auction houses and provide a place for buyers and sellers to connect.

Can a NFT be deleted?

Yes! The only way to delete an NFT is to destroy all copies of the NFT. This means that if you want to remove your NFT from circulation, you will have to make sure that no one else owns a copy of it.

Links

What is the future of NFTs?

The future of NFTs is very exciting. With the help of blockchain technology, NFTs can revolutionize the way we trade and interact with digital content. We can expect to see more NFT marketplaces popping up in the near future, and the technology behind NFTs will only become more sophisticated. As more people become aware of NFTs, we can expect to see even more innovation in this space.